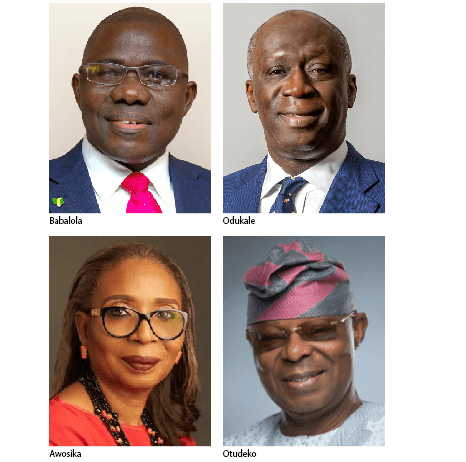

The high-wire politics rocking the management board of Nigeria’s oldest bank, FirstBank Holdings Plc and FirstBank Ltd has taken the scalp of Oba Otudeko, chairman of the group, and Ibukun Awosika, the chairman of the bank.

Otudeko was replaced with Remi Babalola as new chairman of the group, while Tunde Hassan-Odukale steps in as chairman of the bank, in a regulatory intervention by the Central Bank of Nigeria (CBN) yesterday.

The board of directors of FirstBank had announced the appointment of Mr Gbenga Shobo as the new managing director/chief executive officer, replacing Sola Adeduntan as the managing director of the bank, a move that was reversed by the CBN yesterday.

FirstBank has been under regulatory intervention and forbearance regime since 2016 due to financial conditions with its capital adequacy ratio (CAR) and non-performing loans ratio (NPL) substantially breaching acceptable prudential standards since the 2016 financial year.

The insiders who took loans in the bank, with controlling influence on the board of directors, failed to adhere to the terms for the restructuring of their credit facilities which contributed to the poor financial state of the bank.

The CBN’s target examination as at December 31, 2020 revealed that insider loans were materially non-compliant with restructure terms (non-perfection of lien on shares/collateral arrangements) for over three years despite several regulatory reminders.

Apart from that, official sources revealed that the bank had not also divested its non-permissible holdings in non-financial entities in line with regulatory directives.

The problems at the bank were attributed to bad credit decisions, significant non-performing insider loans and poor corporate governance practices.

“The shareholders of the bank and FBN Holding Plc also lacked the capacity to recapitalise the bank to minimum requirements,” the CBN governor disclosed, adding that the apex bank took the decision to preserve the bank’s stability so as to protect minority shareholders and depositors.

According to Mr Emefiele, since the appointment of Adeduntan as the managing director of the bank, the NPLs and insider abuses had been reduced significantly.

The CBN governor said he had pleaded with Otudeko to allow Adeduntan to complete his tenure by December 2021 but he refused to head his entrities.

“The CBN has been satisfied working with Dr Adeduntan,” Emefiele said in a media briefing yesterday in Abuja.

Notwithstanding the significant improvement in the bank’s financial condition with a positive trajectory of financial soundness indicators, the insider related facilities remained problematic.

Emefiele said the CBN is a key stakeholder in management changes involving FBN due to the forbearances and close monitoring by the bank over the last five years aimed at stemming the slide in the going concern status of the bank.

Emefiele said the board effected the executive management change without engagement.

“The action by the board of FBN sends a negative signal to the market on the stability of leadership on the board and management,” Emefiele said.

FBN has over 31 million customers, with a deposit base of N4.2trn, shareholders’ funds of N618 billion and NIBSS instant payment processing capacity of 22 per cent of the banking industry.

Emefiele said the decision was taken not just to protect the minority shareholders but to protect the over 31 million customers of the bank who see FBN as a safe haven for their hard-earned savings.

One of the regulatory actions the CBN took was the granting of the regulatory forbearances to enable the bank work out its non-performing loans through provision for the write off of at least N150bn from its earnings for four consecutive years.

Part of efforts by the CBN’s supervision team was the granting of concession to insider borrowers to restructure their non-performing credit facilities under very stringent conditions and renewal of the forbearances on a yearly basis between 2016 and 2020 following thorough monitoring of progress towards exiting from the forbearance measures.

Dr. Fatade Abiodun Oluwole, Kofo Dosekun, Remi Lasaki, Dr Alimi Abdulrasaq, Ahmed Modibbo, Khalifa Imam, Sir Peter Aliogo and UK Eke – Managing Director were appointed directors for the Holding company.

On other hand, Gbenga Shobo was appointed as deputy managing director; Remi Oni, executive director; Abdullahi Ibrahim, executive director for the bank. Other directors are Tokunbo Martins, Uche Nwokedi, Adekunle Sonola, Isioma Ogodazi, Ebenezer Olufowose and Ishaya Elijah B. Dodo.

Report by MARK ITSIBOR of Leadership Newspaper